By: Leseli Mahloane

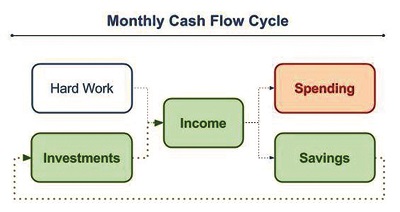

Money is a powerful commodity that plays a crucial role in our lives. It moves from one person to another, creating a cycle that keeps the economy running smoothly. Understanding this cycle can help us make better financial decisions and take control of our finances.

The cycle of money starts when people earn disposable income through employment or business. They receive a paycheck or income, which becomes the starting point of the cycle. From there, the money moves to the next phase – spending or consumption.

Spending is when people use their disposable income to purchase goods or services. They purchase things they need or want, such as food, clothes, and entertainment. When money is spent, it goes to businesses and individuals who provide those goods and services (firms). This is an important part of the cycle because it helps businesses generate revenue and sustain their operations.

Once businesses receive money from customers, they use a portion of it to pay their expenses. Expenses are composed of variable costs and fixed costs. They include things like rent, employee salaries, and raw materials. By paying these expenses, businesses support other individuals and entities in the economy, creating a chain of transactions.

After paying expenses, businesses may also save some money. They put it aside for future needs or invest it to grow their operations. Saving and investing are essential steps in the money cycle because they allow money to grow and create more opportunities for businesses and individuals.

When businesses save or invest money, it often goes to banks or financial institutions. These institutions play a crucial role in the money cycle by providing loans and financial services. They lend money to individuals and businesses who need it for various purposes, such as buying a house or expanding a business. By providing these loans, banks keep the cycle of money moving and support economic growth.

Once individuals or businesses borrow money, they enter the phase of repayment. They gradually pay back the borrowed together with interest. Repayment ensures that the money borrowed is returned to the financial institutions, making it available for others to borrow in the future.

The cycle of money continues as people earn income again, and the process repeats. It is an ongoing cycle that fuels economic activity and allows money to circulate within the economy. Each transaction contributes to the growth and development of businesses and individuals, creating a healthy and vibrant economy.

Understanding the cycle of money can help us make wise financial decisions. By managing our expenses, saving, and investing wisely, we can ensure our money works for us and contributes to our financial well-being. It also reminds us of the importance of supporting local businesses and the larger economy through our spending.

In conclusion, the cycle of money is a continuous process that involves earning, spending, saving, investing, borrowing, and repaying. It moves from one person to another, supporting businesses and individuals in the economy. By understanding and actively participating in this cycle, we can make the most of our money and contribute to a thriving economy.